Resolve your concerns

Transaction Disputes

Ensure debit and credit card transactions are accurate and authorized.

Disputing a charge

When you use a debit or credit card, you may occasionally disagree with a charge on your account. Here are the steps you should take in the event of an unauthorized charge, billing discrepancy or unfulfilled refund.

Step 1—Start with the merchant

Working directly with the merchant will usually provide you with the quickest resolution. The merchant has complete access to the information regarding your purchase and is best prepared to assist you with any discrepancies. Allow 15 days after notifying the merchant for them to credit your account.

Step 2—Contact Mountain America

If working with the merchant is unsuccessful, you can file a dispute with the card issuer—in this case, Mountain America. Typically, the card transaction should be within the past 60 days to file a dispute.

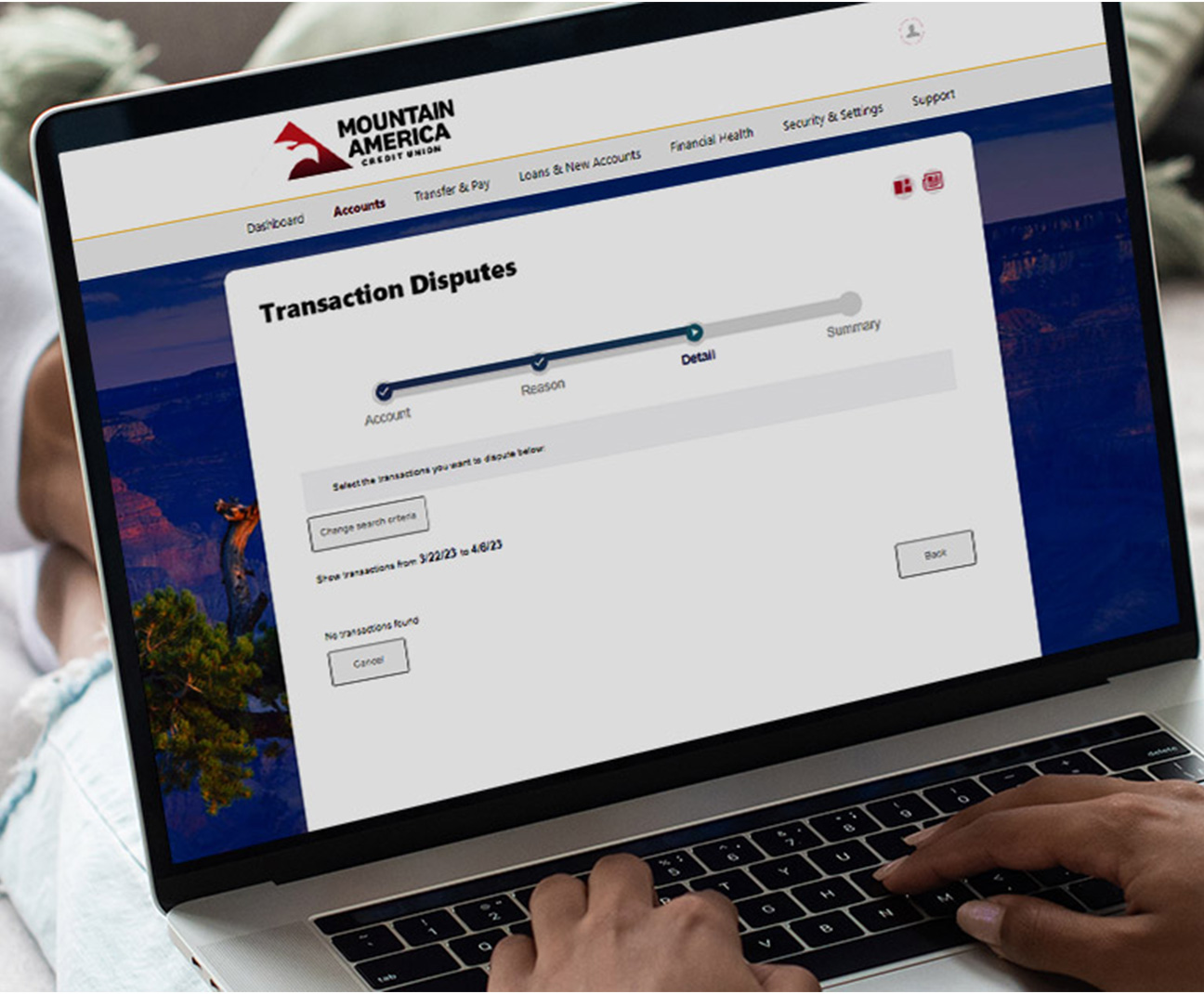

Video instructions

Check out this video for a step-by-step guide to the dispute process

How to file a dispute

- Log in to your online banking or the mobile app.

- Choose Accounts.

- Select Transaction Disputes.

- Follow the instructions.

- We will investigate the charge on your behalf.

You may also visit your local branch, contact the service center at 1-800-748-4302 or send a letter to:

Mountain America Credit Union

P.O. Box 2331

Sandy, UT 84091

Please provide your name, phone number, the last four digits of your account number and a brief explanation of the disputed charges.

To dispute an ACH transaction for:

- Personal accounts, contact 1-800-748-4302

- Business accounts, contact 1-888-845-1850

What happens after you file a dispute?

A dispute normally takes about 90 days to resolve. However, the final resolution may take longer as Mountain America pursues every option available through Visa®. We will provide you a provisional credit while we work through the process. We will notify you of the final resolution via email or mail.

Download the app

App StoreGoogle PlayDispute FAQs

Do I have to pay for a disputed transaction while it is being investigated?

No, we place a provisional credit on your account while we investigate a disputed transaction. However, we may not provide credit if the transaction is not reported within 60 days.

How long do I have to report a disputed charge?

You must report a fraudulent transaction within 60 days of receiving your account statement. For non-fraud transactions, the timeframe may be extended. Please file a claim for our review, and we will get back to you within 10 business days with possible next steps. To ensure a timely resolution, please file the dispute promptly after attempting to resolve the issue with the merchant.

How do I know if the dispute has closed in my favor?

You will receive a letter or email with the outcome or decision of the claim. To check the status of your claim, click Review existing dispute in our Transaction Dispute tool via online banking or our mobile app. If you have questions, please contact Mountain America's fraud and dispute team at 1-800-546-7670.

What types of transactions can I dispute?

You may dispute debit card, credit card and ATM transactions.

What happens after I report a dispute?

We will place a provisional credit on your account while we investigate the claim. You will receive a letter or email within 10 business days with an update.

What documents may be required to support a dispute?

The required documents may vary depending on the type of claim. Commonly required documents include:

- Proof of payment (cash receipt, front and back of a canceled check, credit card statement, etc.).

- Refund receipt.

- Cancellation of merchandise/services document.