Small Business Retirement Plans

A retirement plan may seem like a luxury, but it's actually a benefit for you and your employees.

Businesses come in a variety of sizes and configurations, and so do small business retirement plans. Our specialists are ready to help you evaluate your company’s retirement plan needs. We’ll consider key factors, such as cost, plan features, recordkeeping services, tax implications and investment choices.

Retirement plans we offer include:

- Defined benefit 403(b)

- 457

- Profit-sharing plan

- Cash balance¹

- Non-qualified deferred compensation (NQDC)

- Employee stock ownership plan (ESOP)

If you’d like to discuss retirement plans for your business, contact Mountain America Investment Services to schedule a no-obligation consultation. Simply schedule an appointment by clicking the button below or calling 801-325-1903. We look forward to meeting with you.

Schedule an appointment

Services for Employers

Services for Employees

Services for Employers

When you choose us as your business retirement plan provider, we’ll guide you every step of the way. Our services include:

Plan design support

We can help you evaluate the available plans and choose one that best fits your company.

Provider search assistance

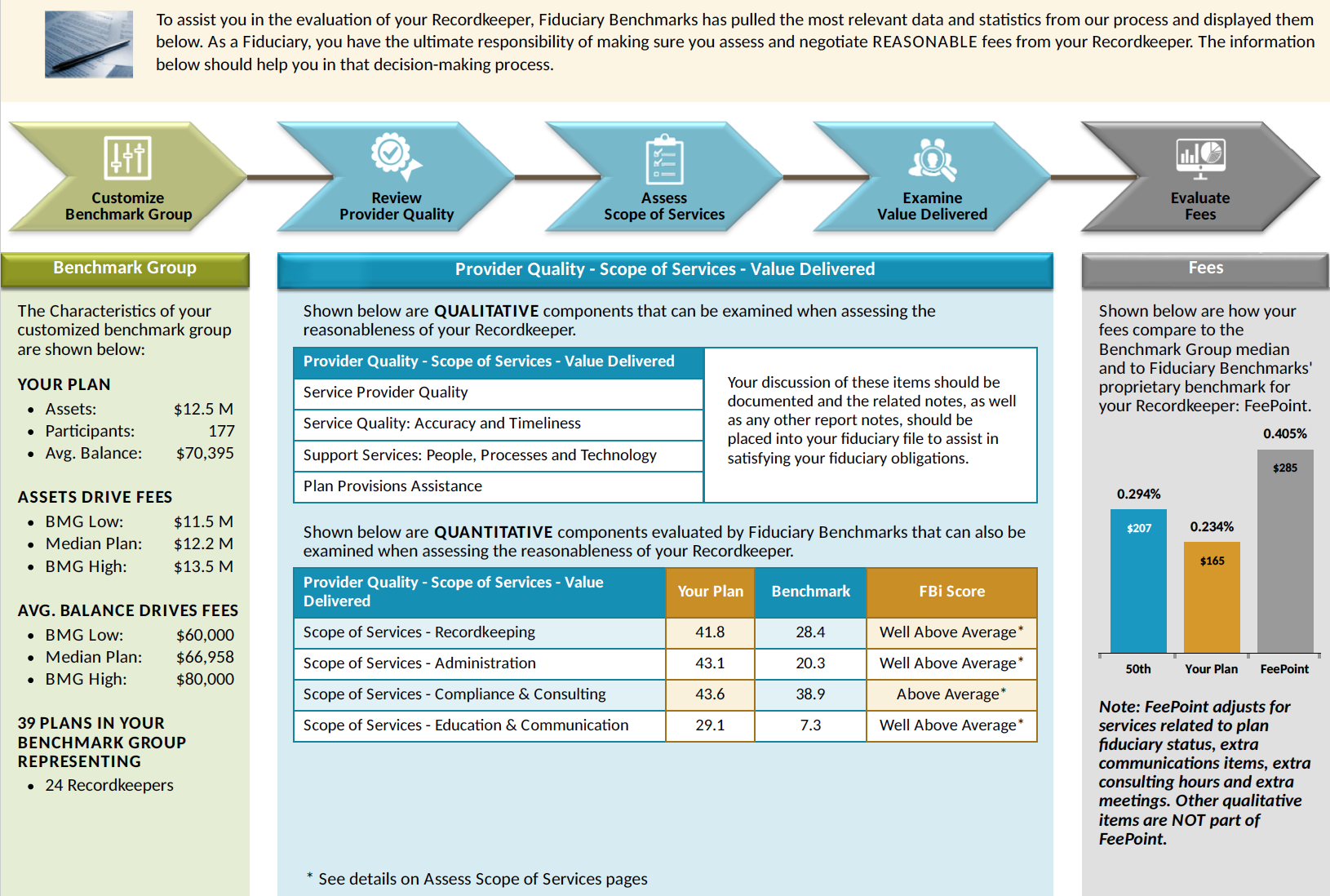

Supervise plan service providers by conducting periodic provider searches. Our process leverages a robust database of plan providers and asset managers to fully automate the provider RFP process. Benefit from our streamlined workflows by using our RFP templates, or completely customize your questions to suit your needs.

Plan compliance support

Get the help you need to address economic and regulatory challenges, as well as fiduciary concerns, by meeting regularly with our specialists. Using industry checklists, we’ll help you consider important questions about your plan and service providers. We’ll also help archive your plan compliance activities in an online plan vault so they can be retrieved at any time.

Investment and fee benchmarking

Our specialists help you develop an investment policy statement to provide the criteria for adding and removing funds from your lineup. Regular reports compare up to five service provider portfolios for fees and performance, demonstrating the relative strengths and weaknesses of fund options.

Without guidance, it can be difficult to know how much you are paying in fees. Some plan fees are built into the cost of the investments, while others are billed directly to the sponsoring employer. Our approach gathers fee details from the service providers themselves and presents them in a clear format in order to judge reasonableness.

Receive a complimentary plan benchmarking report

Services for Employees

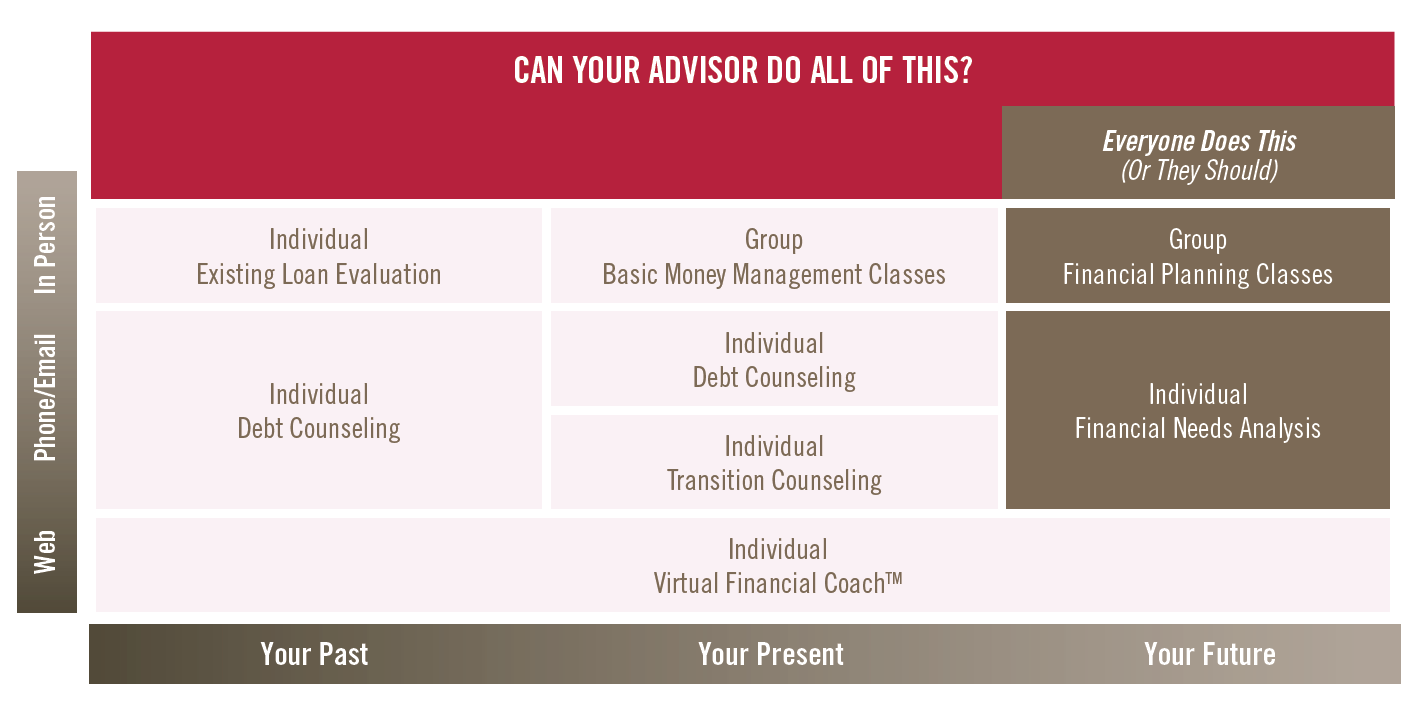

Help your employees with the past, present and future. Regardless of their location ortheir preference, we have a way for them to get retirement planning assistance.

Past

Past spending decisions affect employees, their retirement readiness and their overall financial health for many years to come. Improving employees’ financial wellness can have a positive effect on your bottom line by reducing absenteeism, increasing productivity and alleviating healthcare costs. Through our team, your employees can get group education and individual counseling on topics like credit card debt, auto and home loans, student debt, credit scores and more.

Present

Making good decisions today will help your employees get more out of their paycheck. Our team provides proactive support to your employees when they join the plan and when they leave. By offering to assist employees consolidate their retirement savings, we help keep plan costs as low as possible. In the meantime, our basic money management specialists offer classes on buying a car, buying a home, budgeting and more. This helps employees make more informed decisions going forward.

Future

Group retirement and financial planning classes, combined with individual financial needs analysis by a dedicated wealth advisor, will help your employees make informed decisions during open enrollment and throughout the year. Your business has a lot to gain by your employees being retirement ready. Both you and your employees have much to gain by making the most of whatever rewards your company offers.

Receive our whitepaper

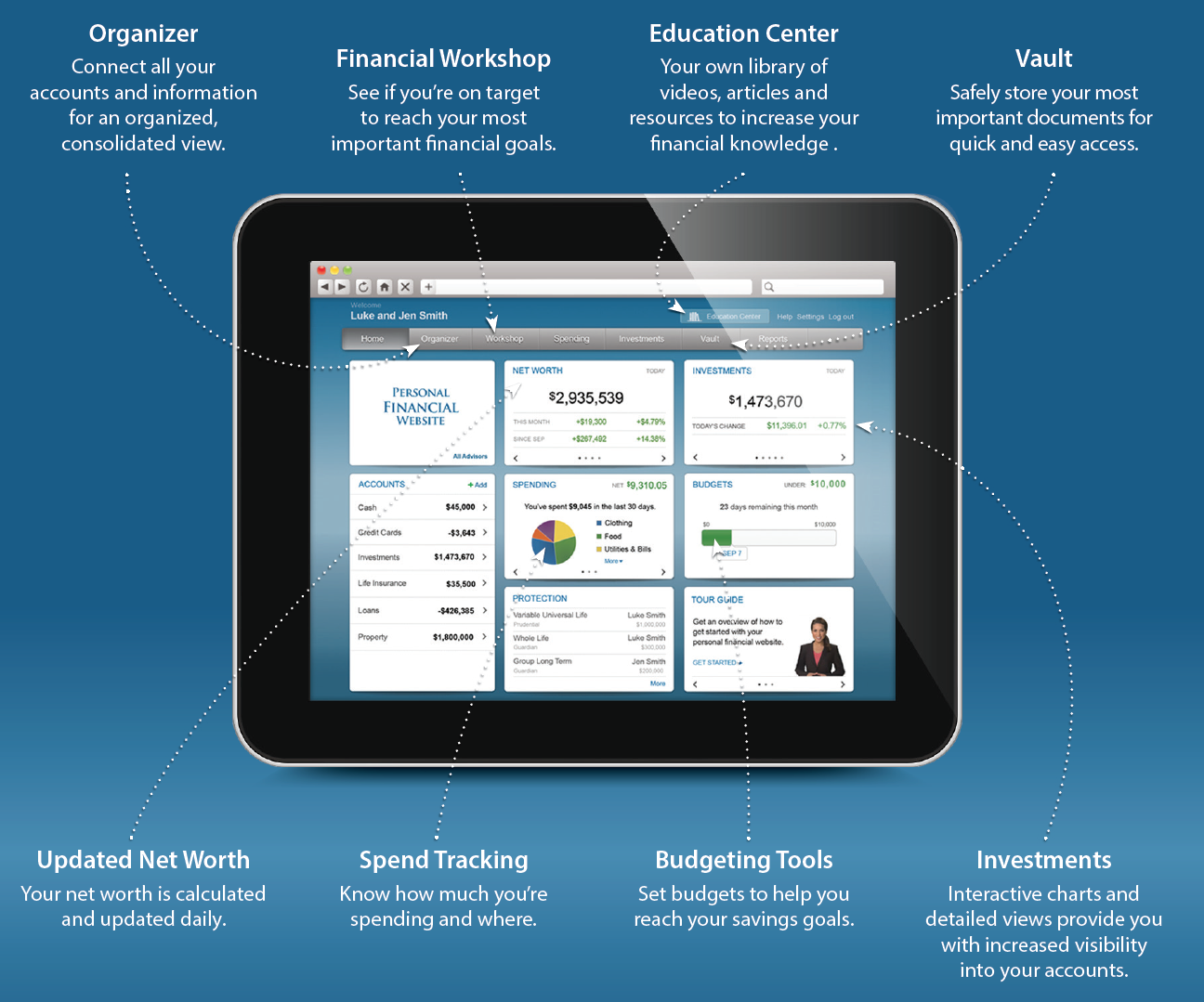

Virtual Financial Coach™

In addition to individual and group sessions with our team, employees can use our Virtual Financial Coach program to monitor their financial picture on their personalized financial homepages. Workshops, populated with employees' unique financial information, help them answer these common financial planning questions:

- Are your personal finances balanced?

- Are your investments allocated properly?

- Are you saving enough for retirement?

- Are your retirement expenses covered?

- Are you saving enough for college?

- Is your family protected?

Ask a CERTIFIED FINANCIAL PLANNER® (CFP)

If participants in the program get stumped at any point in the workshops or need direction on how to apply what they’ve learned to their personal situation, a CFP® is just a click or call away.

Which retirement plan might be right for your business?

Take this short quiz and find out

Login

For employees

Select the provider for your plan from the list:

To access other accounts and virtual financial coach:

LPL Account LoginFor employers

Select the provider for your plan from the list:

To access plan file vault:

Plan File Vault LoginSmall business retirement plan FAQs

When is a business large enough to offer a retirement plan?

Many businesses can consider a business retirement plan once they’ve been profitable for at least 3 years.

Do I have to include all employees?

Non-qualified programs can be very selective about the employees they include. Qualified plans offer some flexibility in regards to eligibility and vesting for employer contributions.

What retirement plan is best for small business?

The best retirement plan for your small business depends mainly on two factors:

- If you have employees other than yourself, your spouse, business partners and their spouses.

- If you want employees to contribute to their plan through payroll deductions.

We can help you choose the right plan for your situation.

Can a small business owner have a 401(k)?

Yes, any size business can offer a 401(k), even the self-employed. One option for small business owners is the solo 401(k) or one-participant 401(k) plan.

Are small businesses required to offer retirement plans?

No employer, including small businesses, is required to offer retirement plans. Those who do choose to offer retirement benefits must meet certain criteria.

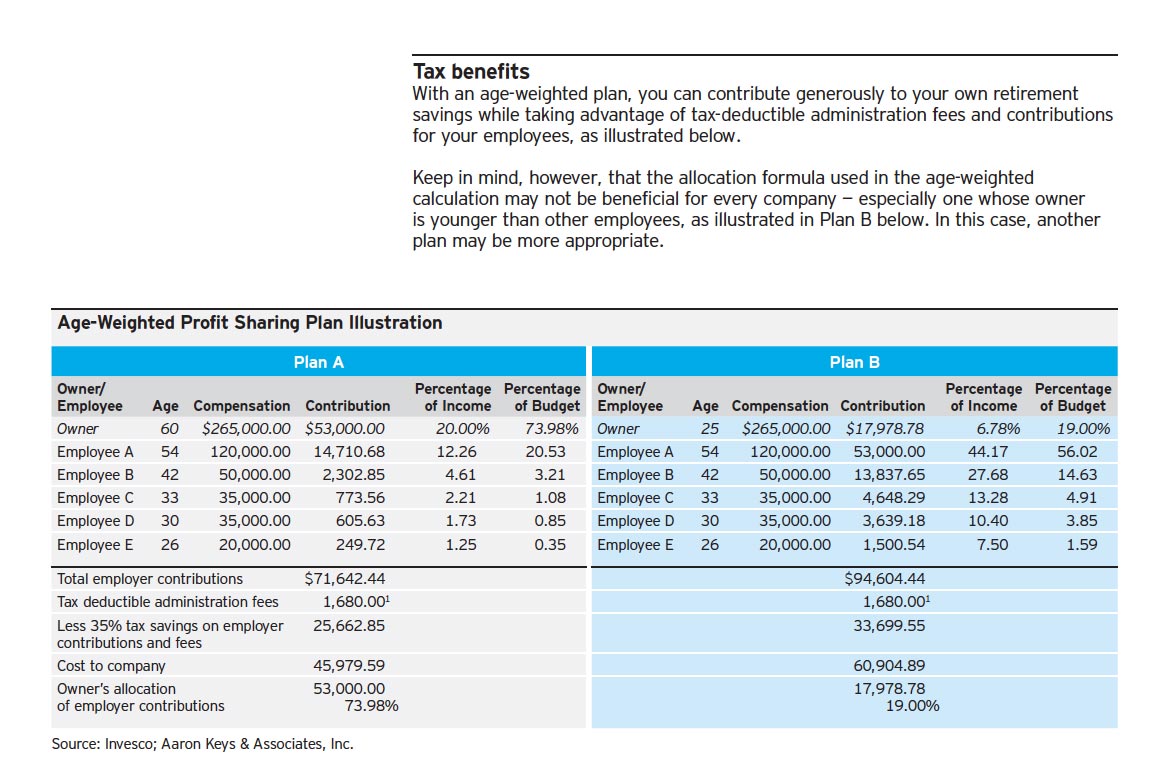

Can I afford to offer a retirement plan to my employees?

Depending on your tax bracket, tax savings can partially or completely offset the costs of administration and contributions for employees. Here is a specific example of how a simplified employee pension (SEP) plan benefits the employer and employees:

Quarterly Newsletters

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed |

| Not Credit Union Deposits or Obligations | May Lose Value |

This site is designed for U.S. residents only. The services offered within this site are available exclusively through our U.S. Investment Representatives. LPL Financial U.S. Investment Representatives may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state.

Mountain America Credit Union (“Mountain America”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Mountain America for these referrals. This creates an incentive for Mountain America to make these referrals, resulting in a conflict of interest. Mountain America is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html.

LPL Financial Form CRS.