Newsletter

Winter 2023

President's Message

Your Financial Independence Is Our Priority

Our simple beginning as a shared cooperative still guides our direction today. Learn three ways Mountain America is committed to improving members’ lives and guiding you toward financial success.

Feature

Focusing On Your Safety

Your financial security is one of our key commitments. Mountain America is dedicated to making it safe and easy to manage your finances and access resources to protect yourself online.

Feature

Four Retirement Resolutions for 2023

Make resolutions this year that your future self will thank you for! Create a retirement planning strategy with these four tips.

Feature

New $300,000 Scholarship Program

The Mountain America Foundation was established to promote overall well-being in the communities we serve. Find out about educational scholarship and grant opportunities available to high school seniors and K–12 educators.

Announcement

Get Involved

Are you interested in supporting the direction of Mountain America? The credit union is seeking qualified volunteers to serve on our Board. We are also looking for members who would like to become Mountain America advocates.

Stay in the Loop

Find out what you might be missing out on—receive notifications and other special offers on your phone.

Discover financial tips and guidance.

Receive limited-time promotions, giveaways and discounts.

Get the latest product information.

1/5

How to Maximize

Your Savings

Sterling Nielsen, President/CEO

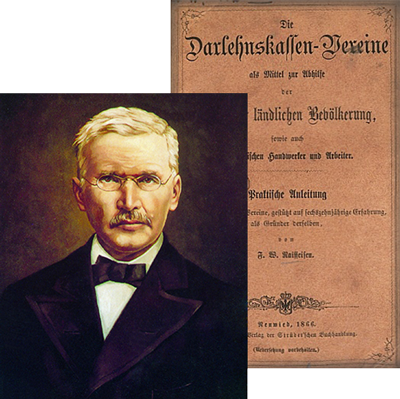

During the harsh winter of 1846–47, Mayor Friedrich W. Raiffeisen decided to do something to protect the suffering farmers in his small town of Flammersfeld, Germany. The big banks and loan sharks had begun demanding as much as 80% interest on loans.

Raiffeisen believed his neighbors and friends could enjoy a better standard of living if they pooled their resources. This first attempt at cooperative self-help was called the Association for Self-procurement of Bread and Fruits.

“We do together what we are too small to do alone.”

—Friedrich W. Raiffeisen

A few years later, he launched the first credit union and wrote instructions and guiding principles for establishing credit cooperatives. This book was a precursor to credit unions today.

For the last 86 years, Mountain America’s purpose has aligned closely to Mayor Raiffeisen’s original vision—to create opportunities for a better life through self-help and mutual solidarity. As a credit union, we strive to set you and your family up for success.

Recently our organization zeroed in on three ways to better support our communities: financial literacy, community engagement and Spanish-language services. These initiatives make the resources our financial cooperative offers to our members more accessible. We are committed to providing increased education and awareness for our over one million members.

1Financial literacy

A solid financial understanding, like learning to read, is one of those critical skillsets for an independent life. This is where we step in to guide you forward. We have an entire team dedicated to doing just that.

Last year alone, our financial literacy team had over 1.4 million virtual and in-person interactions to provide critical education to both members and non-members. These educational opportunities included groups and partnerships with refugees, high school students, small businesses and convicts seeking to rebuild their lives. This integral step of financial literacy is a key turning point toward greater independence and personal freedom.

2Community engagement

While our primary mission is to help our members define and achieve their financial dreams, a close second is to identify areas of underserved needs in our communities.

This past year, we gave over $1 million in grants and community engagement funds to support those around us in meaningful ways. Our employees also logged over 3,000 hours of public service to support community needs.

3Spanish-language services

As the number of Spanish-speaking members has grown over the years, it has become imperative to provide services in their primary language. After all, we want to meet our members where they are.

This has led to a company-wide initiative to develop fully bilingual Spanish hub branches in Utah and Arizona, Spanish financial literacy workshops, translated product resources, and partnerships with media networks and Hispanic associations throughout our footprint.

We are energized by the feedback from our members who have received the support they need to make better financial decisions and guide them forward on their journey. We will continue to expand the services available to our Spanish-speaking members and community.

2/5

Focusing On Your Safety

As we begin 2023, Mountain America remains committed to prioritizing your financial protection and safety.

Our top security priorities in the upcoming year are:

We do this through an ongoing investment in effective security and fraud-detection technology.

Get more details to protect yourself online.

Managing your money with convenience and ease is essential—so is privacy. Watch our video below to learn how to stay safe when using financial apps.

Keep yourself and your finances safe with free access to educational resources—in person and online.

Visit our fraud prevention hub.

"As Mountain America helps our members define and achieve their financial dreams, we will make every effort to provide enhanced digital experiences and increased quality and protection. We are committed to making it safe and easy for members to engage with our products and services however and wherever they want."

—Cathy Smoyer, Executive Vice President of Technology and Risk

Fraud awareness

Fraud continues to be a concern for all. Scams are prevalent, and fraudsters continue to find new ways to victimize consumers.

DO

- Be suspicious if anyone contacts you unexpectedly by phone, text, email or social media.

- Call the service center at 1-800-748-4302 or visit a branch to verify requests to send money, deposit checks or access your account.

- Set up account alerts in digital banking.

DO NOT

- Click on links from unsolicited emails or text messages.

- Give anyone access to your online or mobile banking account.

- Deposit checks for unknown individuals.

Mountain America is your financial partner, ready to help and answer your questions.

3/5

Four Retirement

Resolutions for 2023

Did you ring in the new year with the age-old tradition of making resolutions? Exercising more, losing weight or learning a new skill are goals we have all tried before. This year, consider trying something different to prepare for many happy, new years to come—set your plan for retirement.

Before you dismiss this suggestion, take a moment to picture yourself in 10, 20 or 30 years. (It’s never too early to start planning!) Maybe you're relaxing on the beach, cruising across the country in a luxurious RV or simply enjoying downtime with your extended family. Your future could begin now by following these four easy retirement resolutions.

1Begin or bump up your 401(k) contributions

Many employers give employees the opportunity to invest in a 401(k) or 403(b). Unlike a pension, you need to be proactive to make the most of your employer-sponsored plan. Here are a few best practices:

- At minimum, contribute enough to take advantage of your employer’s matching program. By not doing so, you leave free money on the table.

- Whenever you get a raise, put a portion toward your retirement plan. For example, if your raise is 6%, direct 3% toward retirement accounts.

- Each year, add 1% to your contribution until you reach your comfort level or the maximum amount allowed by your plan.

2Set up automatic contributions to an IRA

The easiest way to save is by automating the process. Schedule biweekly or monthly transfers to your IRA. Not only are you accumulating wealth by saving regularly, but you’re also learning to prioritize your future self by avoiding unnecessary impulse purchases.

Try to meet the annual contribution limit every year. For 2023, the limit is $6,500 or $7,500 for employees 50 or older.

3Review your Social Security statement

While not top of mind for many people, your statement actually contains crucial information for planning your retirement. With it, you can:

- Verify your earnings history.

- Estimate your Social Security benefits.

- View Social Security and Medicare taxes you’ve paid over your lifetime.

View and download your free statement at www.ssa.gov/myaccount.

4Develop a strategy with an advisor

If anything you’ve read has led you to have questions, don’t worry—Mountain America Investment Services is here to help. We have tools to help you create and manage your retirement planning strategy.

Simply call 1-800-540-7670 or schedule a virtual or in-person consultation.

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed |

| Not Credit Union Deposits or Obligations | May Lose Value |

4/5

New $300,000 Scholarship Program

The heartbeat of our credit union is the philosophy of people helping people. In 2020, we established the Mountain America Foundation to promote the health, education and overall well-being of youth and families in the communities we serve. Explore the resources available to you and your neighbors.

5/5

Get Involved

Board Seeks Volunteers

The Board of Directors is seeking qualified volunteers to serve on the Board of the credit union. The Nominating Committee will accept one-page resumes and/or biographical information postmarked no later than Tuesday, February 7, 2023.

Mail information to:

Mountain America Federal Credit Union

Nominating Committee, Attn: Board Application

P.O. Box 2331, Sandy, Utah 84091

Send email submissions to:

boardapplication@macu.com

Become a Mountain America Advocate

Another way to support the credit union is by becoming a Mountain America advocate. Our advocacy efforts seek to ensure that the priorities of our members remain priorities of our government. We do this by:

- Educating lawmakers about the work we do and the freedoms and benefits of credit union membership.

- Providing a proactive, bipartisan approach in favor of the credit union industry.

- Focusing on protections that maintain our not-for-profit status.

Join our advocacy team

Simply email your name, address and mobile number to advocacy@macu.com. You’ll receive periodic updates about current issues as well as ways to reach out to lawmakers.

Subscribe

The Mountain America newsletter has gone 100% digital. To subscribe, submit the form and we'll send you an email as each quarterly issue is released.