The Guide Your Wallet Wants

Quick Summary

Discover how to turn resolutions into real financial progress. This guide offers practical ways to build confidence, stay consistent and make 2026 the year you feel in control of your money—without feeling overwhelmed.

Want to build financial confidence in 2026? January isn’t just the beginning of a new year—it’s the reset moment where plans turn into action. The holidays are behind us, resolutions are fresh and our financial habits are most open to change.

Planning for a confident financial year doesn’t have to be complicated. It simply requires the right mindset and the right tools—tools you already have access to as a Mountain America member.

Think of this guide as a roadmap to align your spending and savings without making your finances feel overwhelming. As you consider your options, you’ll be on your way to more control, less stress and a savings strategy that works with your life, not against it.

Your smart-start checklist for January:

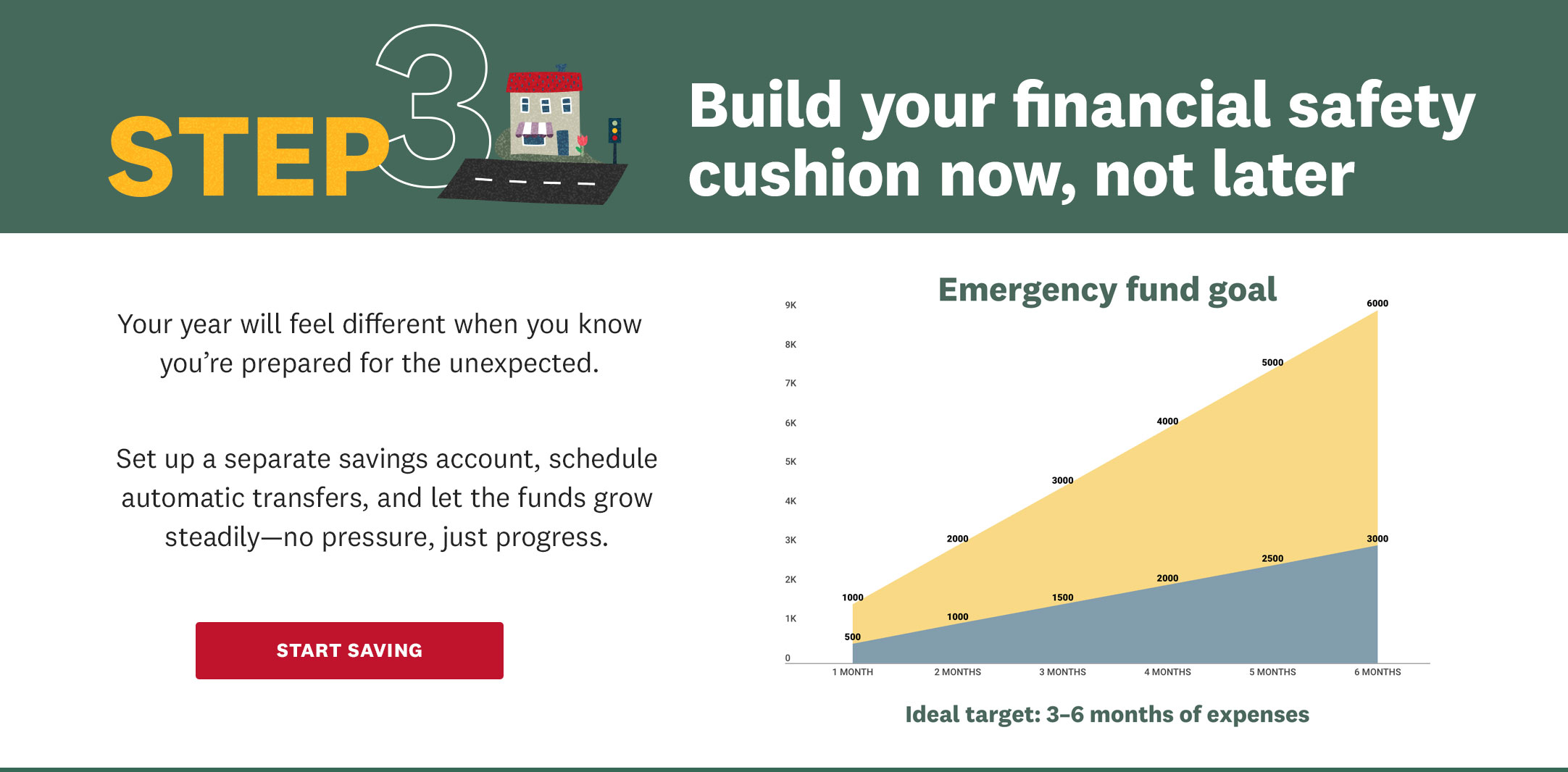

- Open or restart your emergency savings.

- Set up a Christmas Club Certificate to prepare early for holiday expenses.

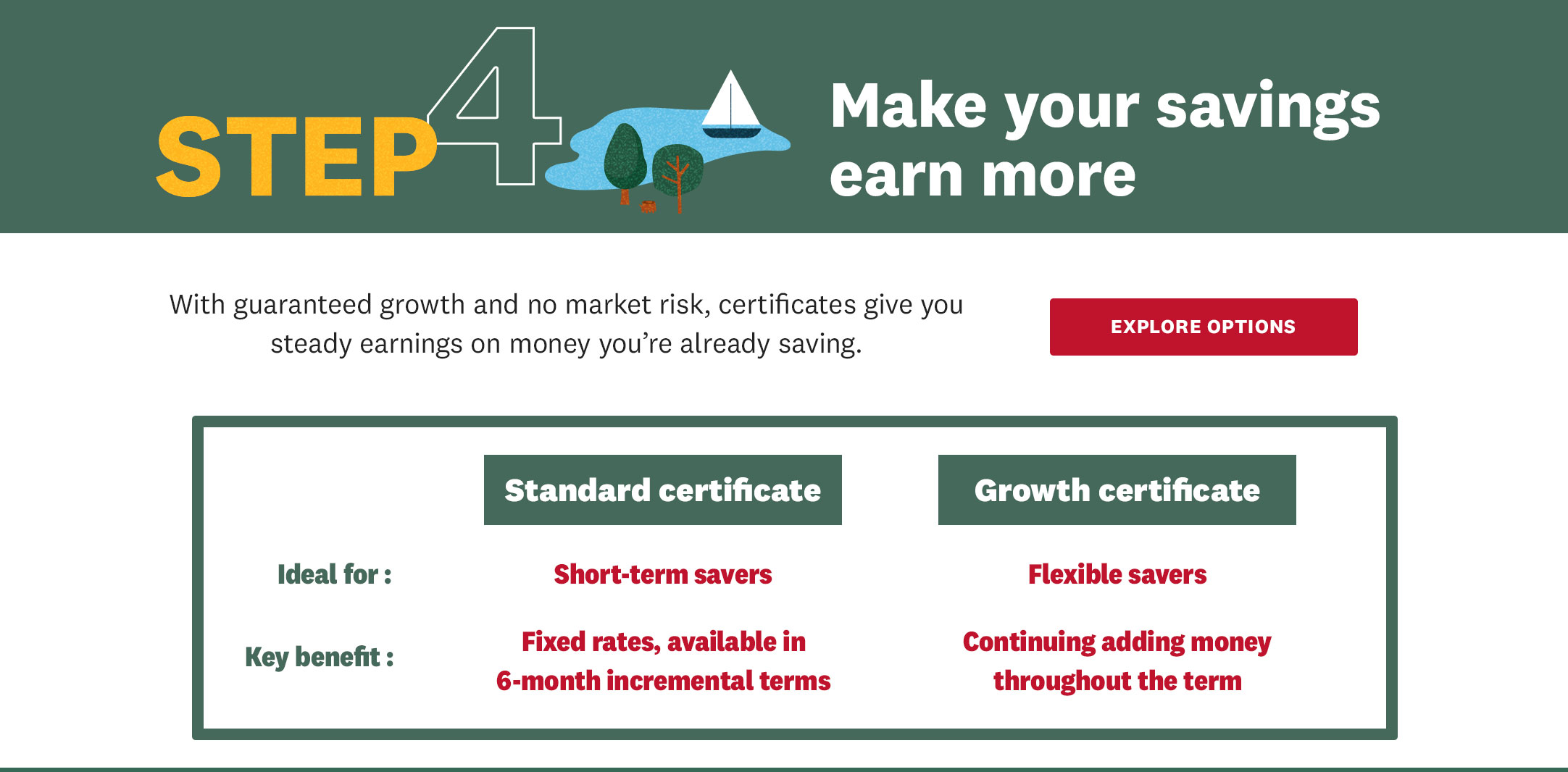

- Pick a certificate option based on your time frame.

- Use your TurboTax member discount.

- Set achievable financial goals in 2026 by registering for our webinar.

Financial goals aren’t built overnight—they are built consistently, one aligned decision at a time.