Easy Do's and Don'ts to Help Fight Fraud

Quick Summary

Keep your money safe with these do's and dont's to keep up with the latest scams.

Scam artists are constantly revising their schemes to fool people out of their money. That’s why it can be difficult to keep up with the latest tricks. Mountain America Credit Union wants your money to stay safe, so we put together this list of easy do’s and don’ts.

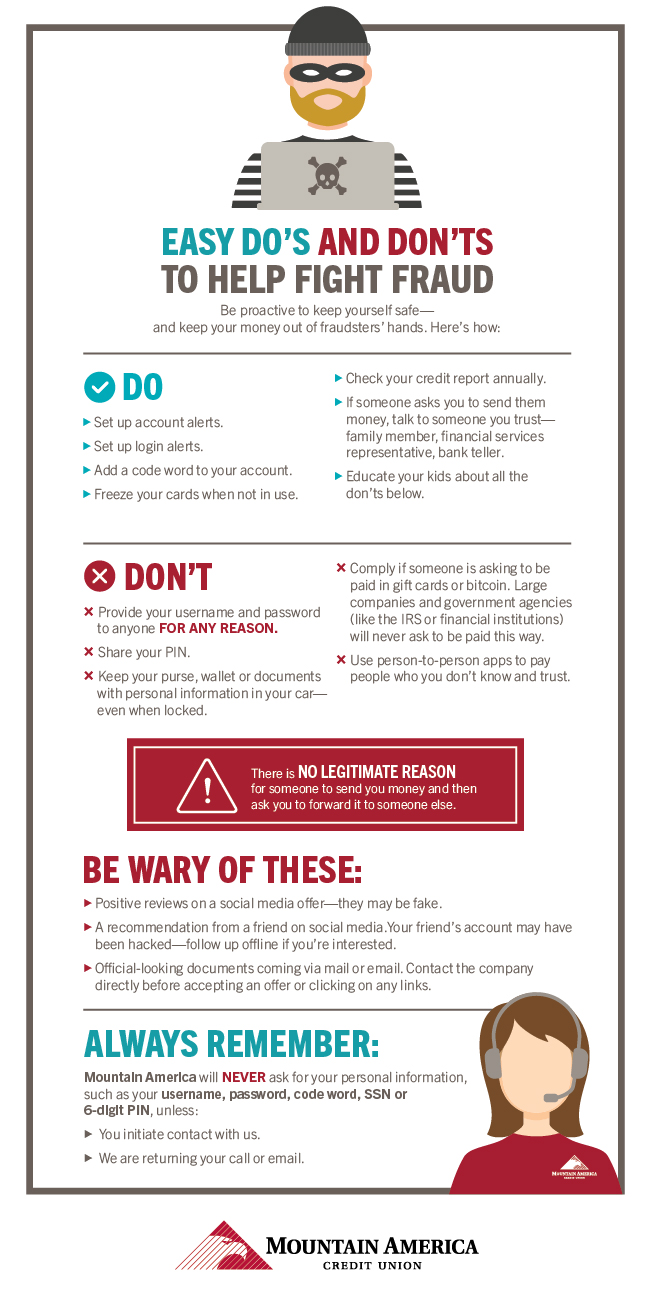

Easy Do’s and Don’ts to Help Fight Fraud

Be proactive to keep yourself safe—and keep your money out of fraudsters’ hands. Here’s how:

DO

- Set up account alerts.

- Set up login alerts.

- Add a code word to your account. Freeze your cards when not in use.

- Check your credit report annually.

- If someone asks you to send them money, talk to someone you trust—family member, financial services representative, bank teller.

- Educate your kids about all the don’ts below.

DON'T

- Provide your username and password to anyone FOR ANY REASON.

- Share your PIN.

- Keep your purse, wallet or documents with personal information in your car—even when locked.

- Comply if someone is asking to be paid in gift cards or bitcoin. Large companies and government agencies (like the IRS or financial institutions) will never ask to be paid this way.

- Use person-to-person apps to pay people who you don’t know and trust.

There is NO LEGITIMATE REASON for someone to send you money and then ask you to forward it to someone else.

Be wary of these:

- Positive reviews on a social media offer—they may be fake.

- A recommendation from a friend on social media. Your friend’s account may have been hacked—follow up offline if you’re interested.

- Official-looking documents coming via mail or email. Contact the company directly before accepting an offer or clicking on any links.

Always remember:

Mountain America will NEVER ask for your personal information, such as your username, password, code word, SSN or 6-digit PIN, unless:

- You initiate contact with us.

- We are returning your call or email.

Please share this information—especially with the younger adults in your life that may not have a lot of experience managing their own finances and recognizing possible fraud.