Open 24/7 for your convenience

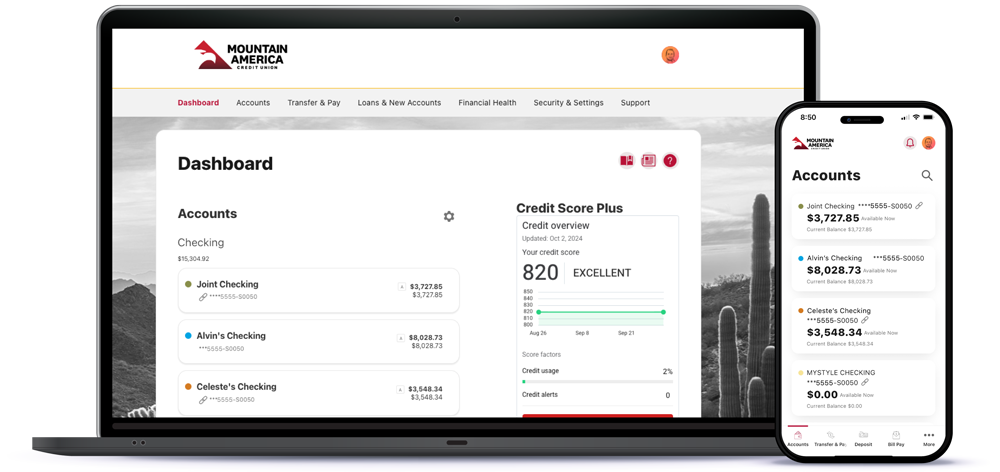

Digital Banking

Members of Mountain America have access to a variety of helpful online and mobile banking services.

Make life easier with digital banking

Stay on top of your finances with Mountain America’s suite of digital banking tools. Most services are available both online and in our mobile app, so you can interact with your accounts on your terms.

Download the app

App StoreGoogle Play

Loaded with features

Make transfers and payments

- Transfer funds between your Mountain America accounts.

- Set up and edit recurring transfers and payments.

- Transfer funds to another Mountain America member.

- Move money between your Mountain America account and accounts you have at other financial institutions.

- Make loan payments from another financial institution with Quick Payments.

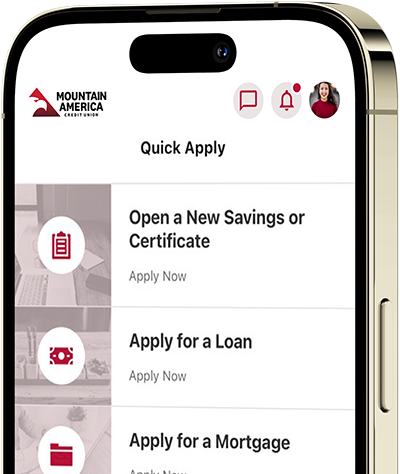

Open new accounts and loans

Set up a new savings or certificate account, or apply for a loan, without getting off the couch.

Deposit checks

Use the mobile app to deposit checks anytime.

Pay bills

Make bill payments anytime to anyone. You can also schedule automatic, recurring payments to save time.

Get alerts

Be notified of low balances, large transactions, card authorizations and more by setting up customized text, email and push notifications.

View documents

Access your statements, notices and other electronic documents.

Send money with Zelle®

Use our mobile app to access Zelle®, a convenient way to send money to people you know and trust using their email or U.S. mobile number.¹

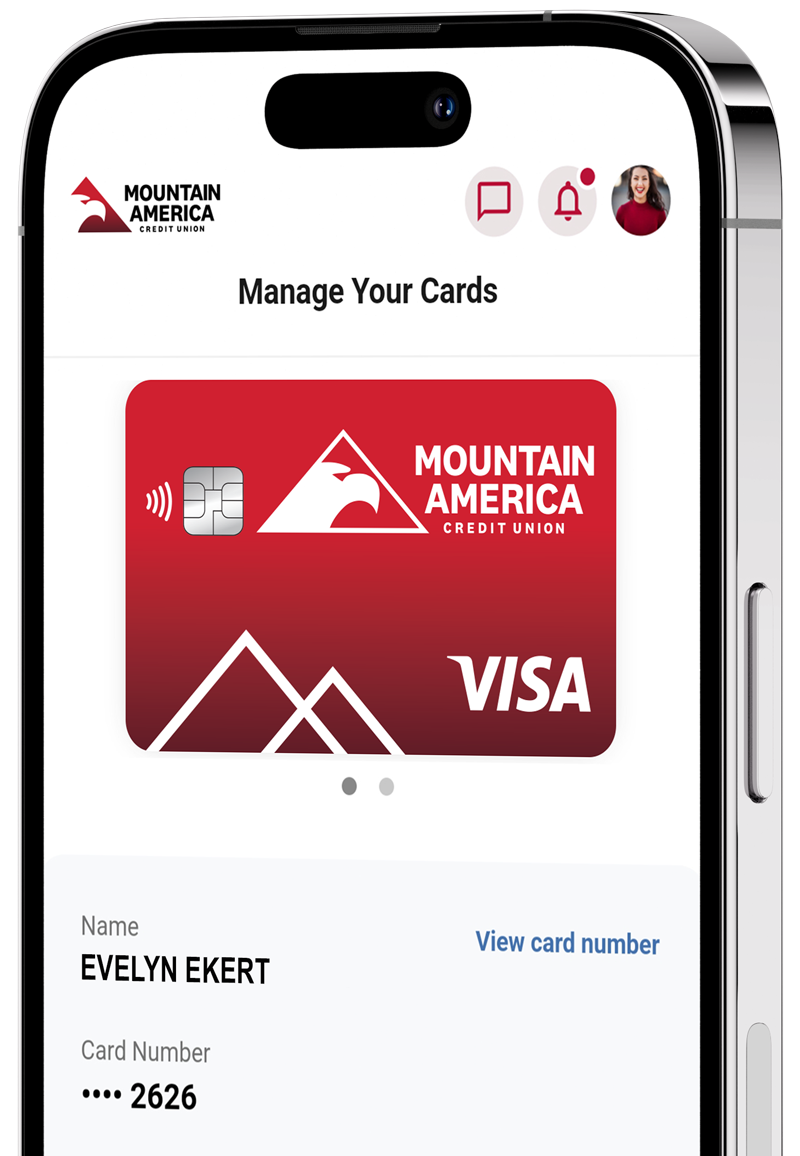

Advantages of Zelle®Manage debit and credit cards

Use our online and mobile card manager to see full card details, block and unblock your card, request a replacement, update your PIN and set travel notices.

See DetailsAccess the rewards center

View your checking and credit card rewards points and redeem them for things like travel rebates, gift cards and event tickets. To get started, choose Accounts from the main menu, then select My Rewards.

Additional resources

Online security

Mountain America provides exceptional online security and a variety of tools to make your digital banking experience as safe as possible.

Free credit score access

View your credit report, see credit alerts and explore how financial choices could change your score.

Lock your credit report

With CreditLock, you can easily lock and unlock your Experian credit report—either through online banking or the mobile app.

- U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.