Line up your future

Retirement Planning

Retirement planning isn’t a game

When a comfortable future is on the line, you want to make smart moves—not ones based on blind picks or dice rolls. Mountain America Investment Services is here to guide you through the planning process with clarity and confidence.

Get direction on a broad array of financial options, including:

- IRAs

- 401(k) options

- Life and long-term care insurance

- Small business retirement plans

- Stocks

- Bonds

- Annuities, ETFs and REITs

Let’s chat

Schedule a free, no-obligation appointment and receive the individual attention you need to make educated retirement decisions based on your financial situation. Use the online scheduler below to set up a consultation. You may also call us at 1‑800‑540‑7670.

Retirement planning FAQs

Do I need to be a credit union member to schedule a consultation?

No, consultations are open to everyone.

What is the best retirement plan?

Retirement planning doesn’t have a one-size-fits-all option. A variety of factors—including your goals, age, current financial status and risk tolerance—need to be considered. A retirement advisor can help you develop an individualized plan.

How do I plan for my retirement?

We highly recommend you start by meeting with a retirement specialist to help you tailor a plan that meets your unique needs.

How much money do I need to save for retirement?

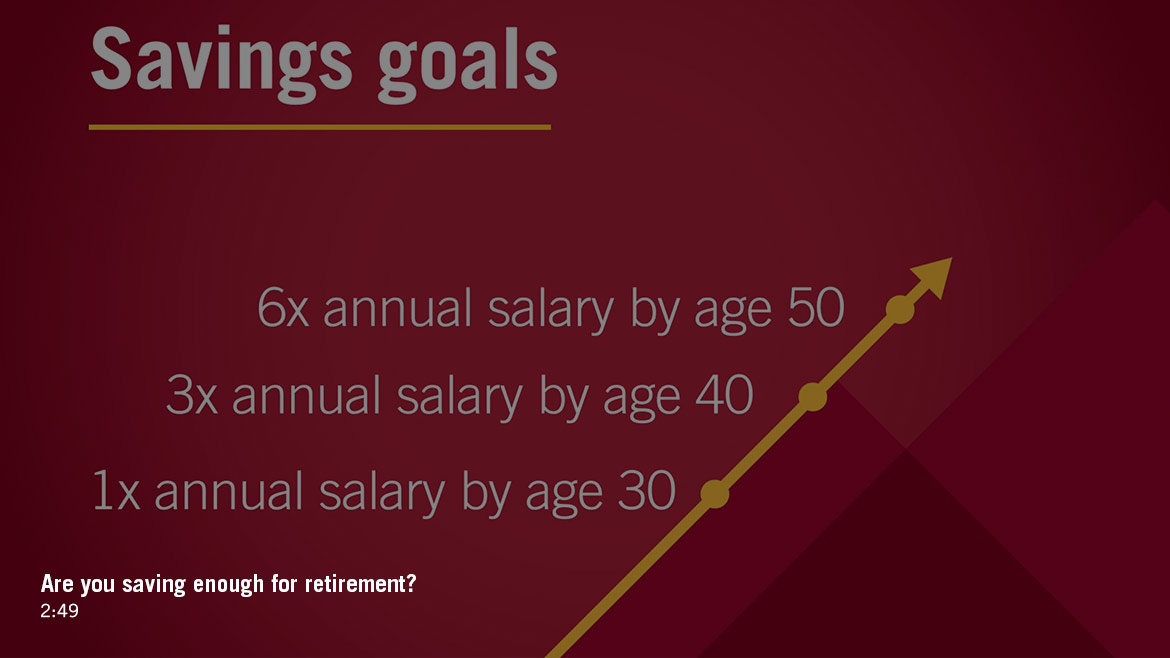

The short answer is “as much as you can.��” But a general rule of thumb is to save 10 times your annual salary by age 65. An advisor can help you set more specific benchmarks.

What is the safest investment for retirement?

All investments involve some risk. Some lower-risk options include certificates (CDs), money market funds, Treasury bills and U.S. savings bonds. An advisor can help you determine the best options for your risk tolerance.

What is the average retirement age?

Schedule an appointment

Wealth management

Budget tips for retirees

Access important financial advice and learn how to make your money go further with income buckets.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Mountain America Credit Union and Mountain America Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Mountain America Investment Services, and may also be employees of Mountain America Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Mountain America Credit Union or Mountain America Investment Services. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed |

| Not Credit Union Deposits or Obligations | May Lose Value |

This site is designed for U.S. residents only. The services offered within this site are available exclusively through our U.S. Investment Representatives. LPL Financial U.S. Investment Representatives may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state.

Mountain America Credit Union (“Mountain America”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Mountain America for these referrals. This creates an incentive for Mountain America to make these referrals, resulting in a conflict of interest. Mountain America is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html.

LPL Financial Form CRS.