President's Message

Spring Into Action Against Imposter Fraud

At Mountain America, we’re here to help you protect your hard-earned assets. Identify key signs of imposter fraud and get recommendations to form an action plan so it doesn’t happen to you.

Feature

Six Tips to Secure Your Loan

Whether you’re looking for an auto loan or mortgage, uncover six ways to help your next financing process go as smoothly as possible.

Feature

Financial Literacy Leads to Empowerment

Our finances impact every area of our lives. Gain the skills and tools needed to make informed decisions. Celebrate Financial Literacy Month by sharing how Mountain America has influenced your financial wellness journey.

Announcement

New Branch Check-in Kiosks

To further provide our members with convenient, personalized service experiences, we have recently added self-serve kiosks in every branch. This new system will help you schedule appointments, know your estimated wait time and get to the right team member more quickly.

Announcement

Annual Business Meeting

As a member, you are invited to attend Mountain America’s Annual Business Meeting on Tuesday, April 16, at 6 p.m. at the Mountain America Center.

Update

In Case You Missed It

Get all the news you may have missed. Choose from recent podcast episodes, inspiring member stories and exclusive member discounts from Mountain America.

Spring Into Action Against Imposter Fraud

Sterling Nielsen,

President/CEOAs spring begins to blossom, I want to shed light on a growing concern in the financial community—imposter fraud. In 2023, imposter scams remained the top fraud category in the United States, resulting in reported losses of $2.7 billion.1 Of those reporting a financial loss, the median impact was $660 per person.2

Fraud affects all of us, whether directly or indirectly, and we are all potential targets. Within our six-state footprint, nearly 40,000 imposter scams were reported last year alone.

Let me share a recent experience where we saved one member from an imposter scam. When the member was attempting to withdraw $5,500, an attentive team member recognized several red flags. Through careful questioning, she uncovered that the member was about to be victimized by a romance scam that could have resulted in more than a $10,000 loss.

The team member promptly filed a report and blocked the scammer's calls. The member left our branch relieved and grateful.

Our top priority is to provide you with exceptional service and protect your hard-earned assets. Our team members are trained to ask questions to help you avoid financial disaster. Read on for key signs of imposter fraud along with tips to protect your accounts.

Thank you for being a part of the Mountain America family and for your help to keep each other safe from fraud!

Sincerely,Sterling Nielsen

Imposter scams occur when fraudsters impersonate trusted businesses, government agencies, religious organizations or individuals. They may pose as an administrative official, distressed relative or technical support expert to convince you to share personal information or send money. The preferred contact method for scammers is often email or text, especially when posing as a business or government agency.

Be wary of threats or demands

Fraudsters prey on a person’s vulnerability and empathy. They may even try to intimidate you by threatening legal consequences or financial ruin. If you receive an unexpected call or email demanding immediate action, pause and verify whether the request is legitimate by contacting the organization directly at their published number.Don’t trust caller ID

Scammers can spoof any number to make it appear as if they are contacting you from a known number. There is no reason for someone to call and ask you to verify who you are.Be on the lookout for authentication requests

If someone contacts you and asks for confidential information—a codeword, password, PIN or payment card information—hang up. Look up the organization’s number and call them directly.

Stay informed

Stay up-to-date on fraud prevention tips and strategies to keep your account safe.Never send money for someone else

If someone sends you money and asks you to send it somewhere else, it is fraud.Verify links before you click

Never click on suspicious or unexpected links via text or email.Report suspicious activity

If an email from Mountain America looks suspicious, report it to phishing@macu.com and forward text messages to 385-336-0337.

Mountain America has joined forces with other credit unions and banks in Utah to form Utah’s Fraud Prevention Coalition. Alongside the Department of Commerce, we’re committed to providing you with knowledge and tools to stay one step ahead of scammers.

Six Tips to Secure Your Loan

The past few years have been challenging for consumers, but thankfully, the market is recovering. Auto inventories are up. Mortgage and loan rates have flattened. People are becoming more confident to make big purchases again.

These economic recoveries are certainly welcome, but we haven’t returned to the easy lending of past decades, especially in the case of housing. Buyers will still need to put in some effort to secure financing.

Here are six ways to give yourself a leg up on a loan approval:

1Shore up your

credit score

Make sure your credit reports are accurate and your credit score is in good shape. A low score or errors on your credit report could delay your loan application or lead to its denial.

Check your Experian®, TransUnion® and Equifax® credit reports for free every year by visiting annualcreditreport.com. Mountain America members with a checking account or loan also have free access to their FICO® Score.1

2Determine how much you can afford

The last thing you want to do when taking out a loan is overextend yourself. To ensure you can make the payments, set aside a few minutes to run the numbers. Luckily you don’t have to use pen and paper to make these calculations anymore. Try our auto loan payment and mortgage payment calculators.

3Comparison shop

With big-ticket purchases, it’s common to shop around for the best price. The same approach should be taken with financing. Explore your options with a handful of financial institutions. We’re confident Mountain America offers among the best rates and terms in your area and will provide you with great service!

4Get prequalified

Now that you know how much you can spend and which lenders have the best loans, you should request a prequalification letter. This document will not only show sellers your maximum borrowing limit, but also that you are serious about buying.

5Have a cosigner

or co-borrower

If it’s difficult to qualify for a loan on your own, consider applying with someone you know and trust—typically a friend or family member. With a cosigner, you are responsible for paying back the loan, and the cosigner only steps in if you are unable to make a payment. A co-borrower, on the other hand, is equally responsible for making loan payments—they also have ownership rights.

6Take advantage of special offers

As coupon-clippers will attest, a good deal can be a huge money saver. Auto and home loans may not have coupons, but discounted rates or special offers may be available.

Mountain America members with MyStyle® Checking can receive a 0.25% rate discount on auto, RV and personal loans.2

For a limited time, we’re also providing free appraisals with new home construction or purchase loans.3

2. Loan discount valid on new loans only. Loans on approved credit.

3. Loans on approved credit. Free appraisal on new purchases and construction loans only. Not available on refinance loans. Cannot be combined with other offers. Limit one per household. Offer valid on applications received between 3/1/24 and 7/31/24 for loans that close no later than 8/31/24. Limited-time offer. Offer can change or be withdrawn at any time.

Financial Literacy Leads to Empowerment

In today’s rapidly evolving economic landscape, financial literacy is more important than ever. In 2003, federal lawmakers began passing resolutions to designate April as Financial Literacy Month.

Why is financial literacy important?

At its core, financial literacy empowers individuals to make informed decisions about their money. It equips us with the skills to create and stick to budgets, distinguish between needs and wants, develop saving habits and plan for long-term goals like retirement.

How would you measure your financial literacy?

Whether you are a money-management master or beginner budgeter, everyone can benefit from acquiring additional knowledge and skills to manage their personal finances effectively.

Mountain America is committed to offering free tools and resources to guide our members on their journey to financial empowerment.

How has your financial wellness journey been supported by Mountain America? Let us know by answering the following questions. Then see how your results compare to other members.

Meet with a financial guide

In April, or any month of the year, take advantage of opportunities to improve your financial literacy level—and empower your decision making for a more secure financial future. Mountain America has a team of coaches to guide you on your financial journey. Utilize this free service to get your credit in order, create a budget or learn more about the lending process.

Make an appointment

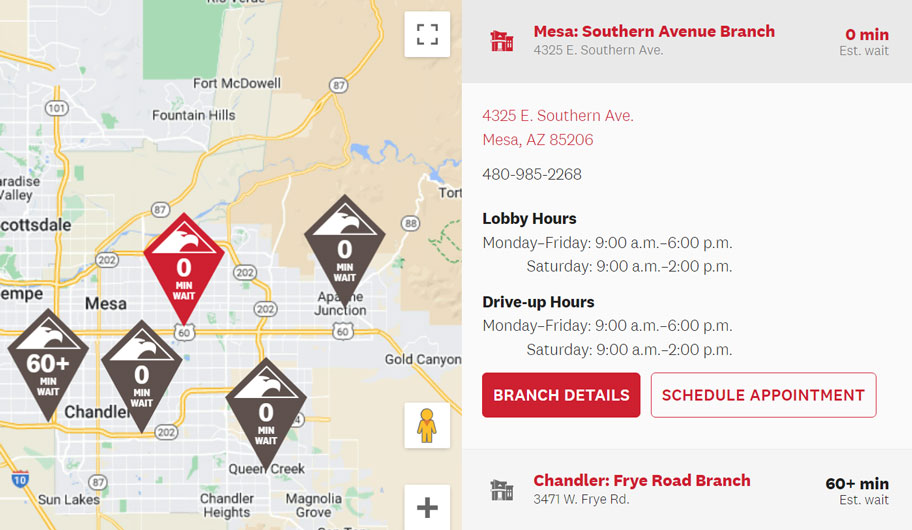

New Branch Check-in Kiosks

When to use the kiosk

Please start at the kiosk when you need to:

- Schedule an appointment with a loan officer, wealth advisor or account representative.

- Check in for a previously scheduled appointment.

- See expected wait times for walk-in appointments.

- Receive a text message when it’s time for your meeting.

Skip the kiosk and head straight to the teller line when you need to:

- Deposit or withdraw money.

- Replace a debit or credit card.

- Complete other day-to-day transactions.

This new system will help us guide you to the right team member more quickly. Also, since you will know your estimated wait time, you can make a phone call, do some online shopping or run a quick errand nearby if you prefer not to wait in the lobby. We’ll text you when it’s time for your appointment.

You can easily schedule an appointment online or through our mobile app. When you arrive for your appointment, simply check in at the kiosk.

The kiosks will provide Mountain America with more accurate information about the appointment types and time slots in high demand, as well as average meeting times. This will allow our managers to hire and schedule team members where they are needed most. Next time you drop by a branch, let us know your thoughts about our new appointment and check-in experience!

At Mountain America, our goal is to provide exceptional member experiences. Our new appointment and check-in system has been designed to add convenience, enhance transparency and be respectful of your time. Additionally, it allows you to meet with the representative of your choosing.

—Jason Rogers, SVP/Chief Member Service Officer

Annual Business Meeting

The Board of Directors is pleased to invite all Mountain America members to attend the Annual Business Meeting.

Tuesday, April 16, 2024

6 p.m.

Mountain America Center

Pinnacle Room—Floor 8 North

9800 South Monroe Street

Sandy, Utah 84070

In Case You Missed It

Enjoy a podcast, watch inspiring member stories and access exclusive member discounts.

Subscribe

The Mountain America newsletter has gone 100% digital. To subscribe, submit the form and we'll send you an email as each quarterly issue is released.