Access your credit score for free

Credit Score Plus

It’s more than a credit score

Having free access to your credit score is essential. After all, your credit score is one of the primary indicators of your financial well-being. With Credit Score Plus from Mountain America, you can easily keep tabs on your score and so much more!

How to access Credit Score Plus

- Log in to online banking or the mobile app.

- From the menu, navigate to Financial Health.

- Select Credit Score Plus.

Additional features of Credit Score Plus

Credit Score Plus is much more than a credit score checker. It also gives you access to:

- View your full credit report.

- Review credit score factors.

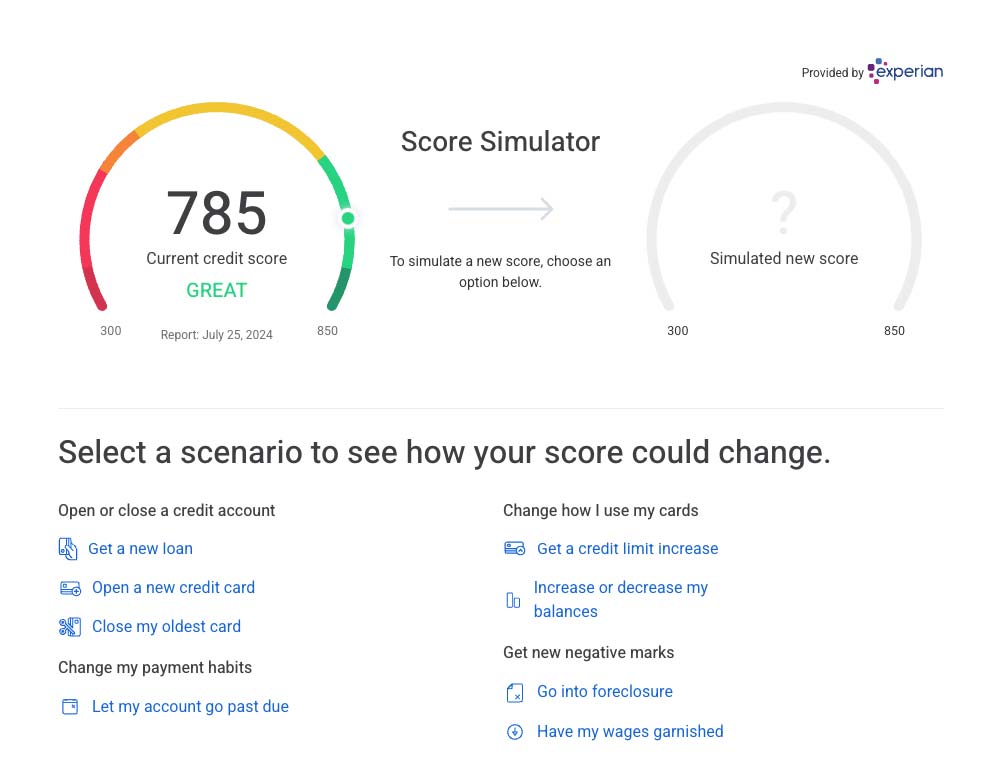

- Run a score simulation to see how different financial choices could impact your credit.

- Receive alerts on changes to your credit that may impact your score.

- Run a debt-to-income analysis.

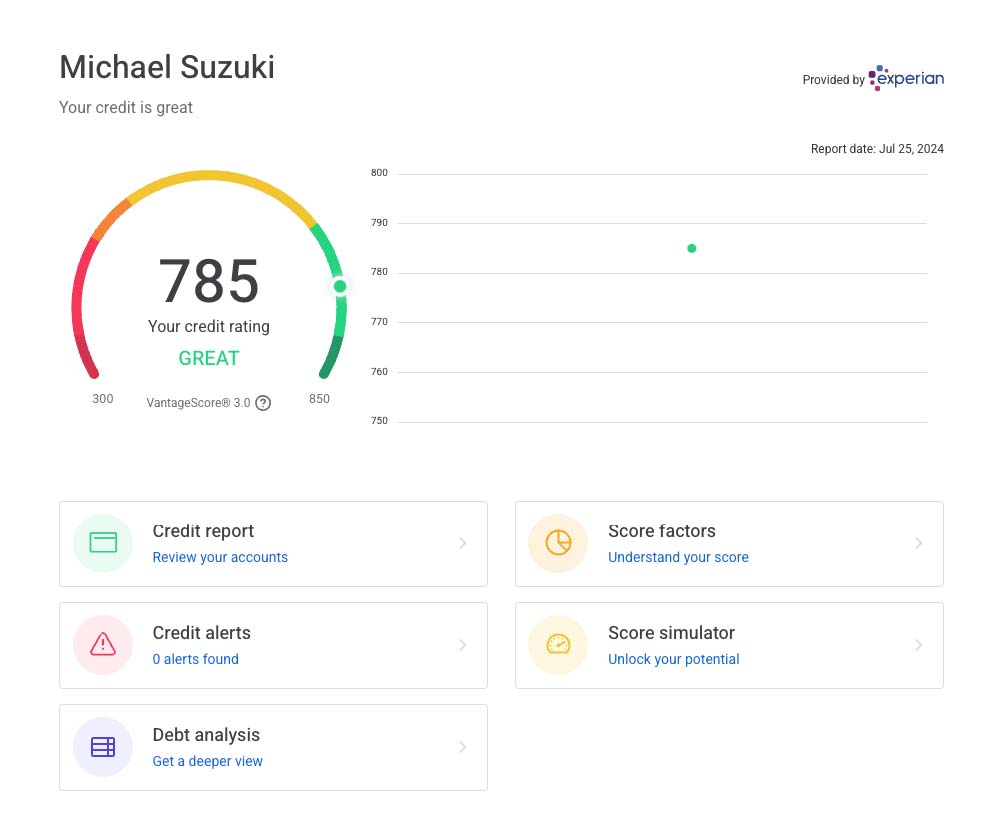

The power of a number

Lenders use your credit score to help determine if you qualify for a loan, and if you do qualify, what rate and terms you can get. The higher the score, the better your chances of securing a favorable loan. Credit Score Plus uses VantageScore 3.0 through Experian.* Scores range from 300 to 850.

559 or less

is considered poor

560–669

is considered fair

670–749

is considered good

750–809

is considered great

810+

is considered excellent

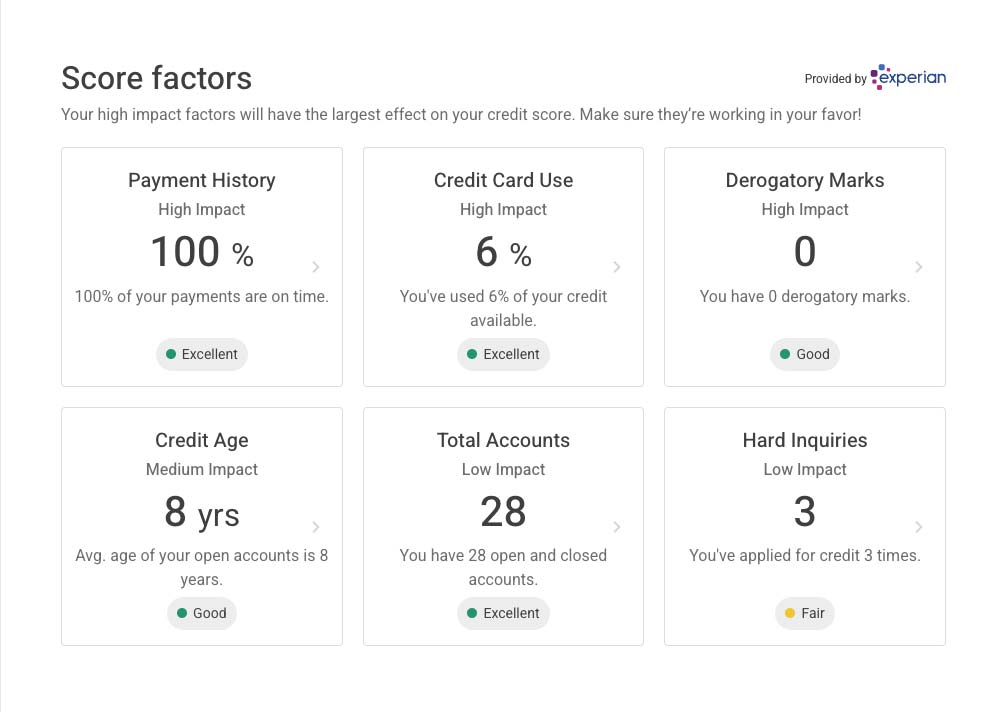

Learn what scores are made of

Credit scores are calculated from many different pieces of data in your credit report. This data is grouped into categories such as:

- Payment history

- Credit card utilization

- Derogatory marks, such as late payments and charge-offs

- Credit age

- Total accounts

- Variety of credit

- Hard inquiries

Try Credit Score Plus today

Simply log in to Mountain America’s mobile banking app or online banking and select Credit Score Plus from the menu.

App StoreGoogle PlayCredit Score FAQs

Will receiving my credit score impact my credit?

No, the credit score we provide does not impact your credit. Viewing your credit score also does not lower it.

Why is my credit score not available?

- You may not have an established credit report with Experian.

- You are not the primary accountholder on your joint account.

What is a credit score?

Credit scores are numbers that summarize your credit risk. Scores are based on a snapshot of your credit file at a particular consumer reporting agency at a particular point in time. It helps lenders evaluate your credit risk. Credit scores influence the credit that’s available to you and the terms that lenders offer you, such as interest rates.

How often will I receive my credit score?

Credit Score Plus is updated monthly, as available from Experian.

Where does the information used to calculate my credit score come from?

Credit scores are based on the credit information in a credit file with a particular consumer reporting agency (CRA) at the time the score is calculated. The information in your credit files is supplied by lenders, collection agencies and court records. Not all lenders report to all three major CRAs. The credit score we provide is based on data from your Experian report as of the "pulled on" date shown with your credit score.

Why is my credit score different from other scores I've seen?

Other organizations could be using a different scoring model. You may also see differences from one credit bureau to another since not all lenders/creditors report to all three nationwide credit bureaus. Finally, credit scores change over time depending on your credit history. When reviewing a score, take note of the score date, consumer reporting agency, credit file source, score type and range for that particular score.

The score displayed within Credit Score Plus is intended for educational purposes only and may differ from the credit score used by Mountain America when applying for a loan.

Why do credit scores change?

There are many reasons why a score may change. Credit scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a particular consumer reporting agency (CRA) at that time. As the information in your credit file at that CRA changes, credit scores can also change. Review your key score factors, which explain what factors from your credit report most affected a score. Comparing key score factors from the two different time periods can help identify causes for a change in your score. Keep in mind that certain events, such as late payments or bankruptcy, can lower credit scores quickly.

How do I check my credit report?

You can review your full credit report within Credit Score Plus. You may also get a free copy of your credit report annually from annualcreditreport.com.